(Colorado Real Estate Journal, December 18-31, 2019, Office Properties Quarterly, p 7 & 17) By Fuller broker, John Becker. Multitenant suburban office often has been described as one of the least desirable product types for investors. High turnover, tenant finish expense and overpaid leasing brokers lead the list of complaints from investors. “Why would I spend money on carpet, brokers and moving walls around when I only need to sweep out a warehouse unit or stick with my safe, low-risk West Coast apartment project?” they ask.

Multifamily investments have experienced such a high historical demand from private clients that rates of return (cap rates) have been relatively low for years, especially on the coasts. Industrial buildings in Colorado have been increasing in value partly as a result of the demand in Denver County for marijuana grow facilities. We see industrial properties trade in the hundreds of dollars per square foot, while it wasn’t long ago that we were still seeing select suburban offices trade for less. But not anymore. Coastal investors are moving into suburban Denver office investments at an increased rate. Possibly chasing yield? Or maybe as a result of multifamily rent controls implemented by voters in New York and California. Either way, coastal investment in non-Denver County suburban office has increased in 2019.

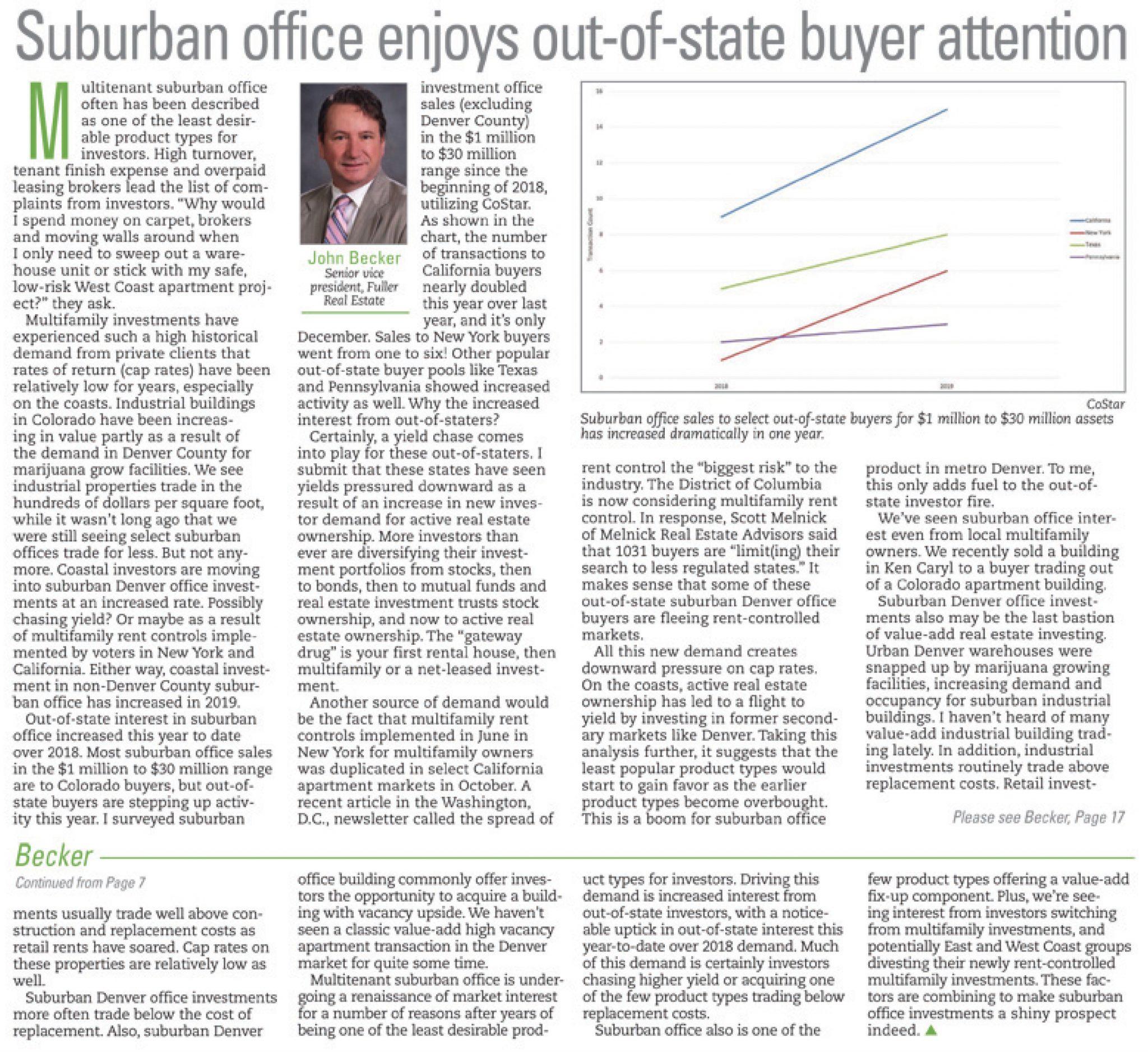

Out-of-state interest in suburban office increased this year to date over 2018. Most suburban office sales in the $1 million to $30 million range are to Colorado buyers, but out-of-state buyers are stepping up activity this year. I surveyed suburban investment office sales (excluding Denver County) in the $1 million to $30 million range since the beginning of 2018, utilizing CoStar. As shown in the chart, the number of transactions to California buyers nearly doubled this year over last year, and it’s only December. Sales to New York buyers went from one to six! Other popular out-of-state buyer pools like Texas and Pennsylvania showed increased activity as well. Why the increased interest from out-of- staters? Certainly, a yield chase comes into play for these out-of-staters. I submit that these states have seen yields pressured downward as a result of an increase in new investor demand for active real estate ownership. More investors than ever are diversifying their investment portfolios from stocks, then to bonds, then to mutual funds and real estate investment trusts stock ownership, and now to active real estate ownership. The “gateway drug” is your first rental house, then multifamily or a net-leased investment.

Another source of demand would be the fact that multifamily rent controls implemented in June in New York for multifamily owners was duplicated in select California apartment markets in October. A recent article in the Washington, D.C., newsletter called the spread of rent control the “biggest risk” to the industry. The District of Columbia is now considering multifamily rent control. In response, Scott Melnick of Melnick Real Estate Advisors said that 1031 buyers are “limit(ing) their search to less regulated states.” It makes sense that some of these out-of-state suburban Denver office buyers are fleeing rent-controlled markets.

All this new demand creates downward pressure on cap rates. On the coasts, active real estate ownership has led to a flight to yield by investing in former secondary markets like Denver. Taking this analysis further, it suggests that the least popular product types would start to gain favor as the earlier product types become overbought. This is a boom for suburban office product in metro Denver. To me, this only adds fuel to the out-of-state investor fire.

We’ve seen suburban office interest even from local multifamily owners. We recently sold a building in Ken Caryl to a buyer trading out of a Colorado apartment building. Suburban Denver office investments also may be the last bastion of value-add real estate investing. Urban Denver warehouses were snapped up by marijuana growing facilities, increasing demand and occupancy for suburban industrial buildings. I haven’t heard of many value-add industrial building trading lately. In addition, industrial investments routinely trade above replacement costs. Retail invest-