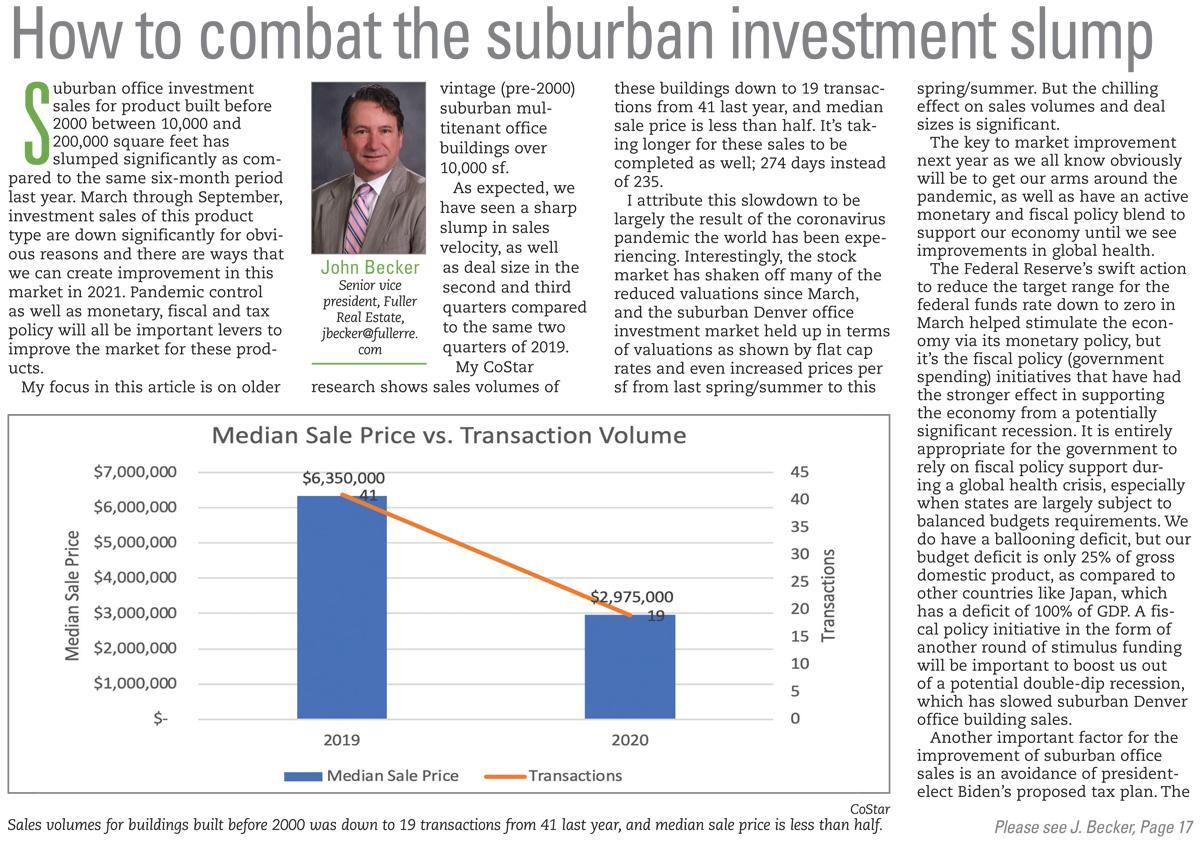

(Source: Colorado Real Estate Journal, Office & Industrial Quarterly, p. 8, December 2020, by John Becker, Sr. Vice President, Fuller Real Estate) Suburban office investment sales for product built before 2000 between 10,000 and 200,000 sq. feet has slumped significantly as compared to the same six-month period last year. March through September, investment sales of this product type are down significantly for obvious reasons and there are ways that we can create improvement in this market in 2021. Pandemic control as well as monetary, fiscal and tax policy will all be important levers to improve the market for these products. My focus in this article is on older vintage (pre-2000) suburban multitenant office buildings over 10,000 sf. As expected, we have seen a sharp slump in sales velocity, as well as deal size in the second and third quarters compared to the same two quarters of 2019. My CoStar research shows sales volumes of these buildings down to 19 transactions from 41 last year, and median sale price is less than half. It’s taking longer for these sales to be completed as well; 274 days instead of 235.

Suburban Investment Article